Business Insurance in and around Colorado Springs

Get your Colorado Springs business covered, right here!

No funny business here

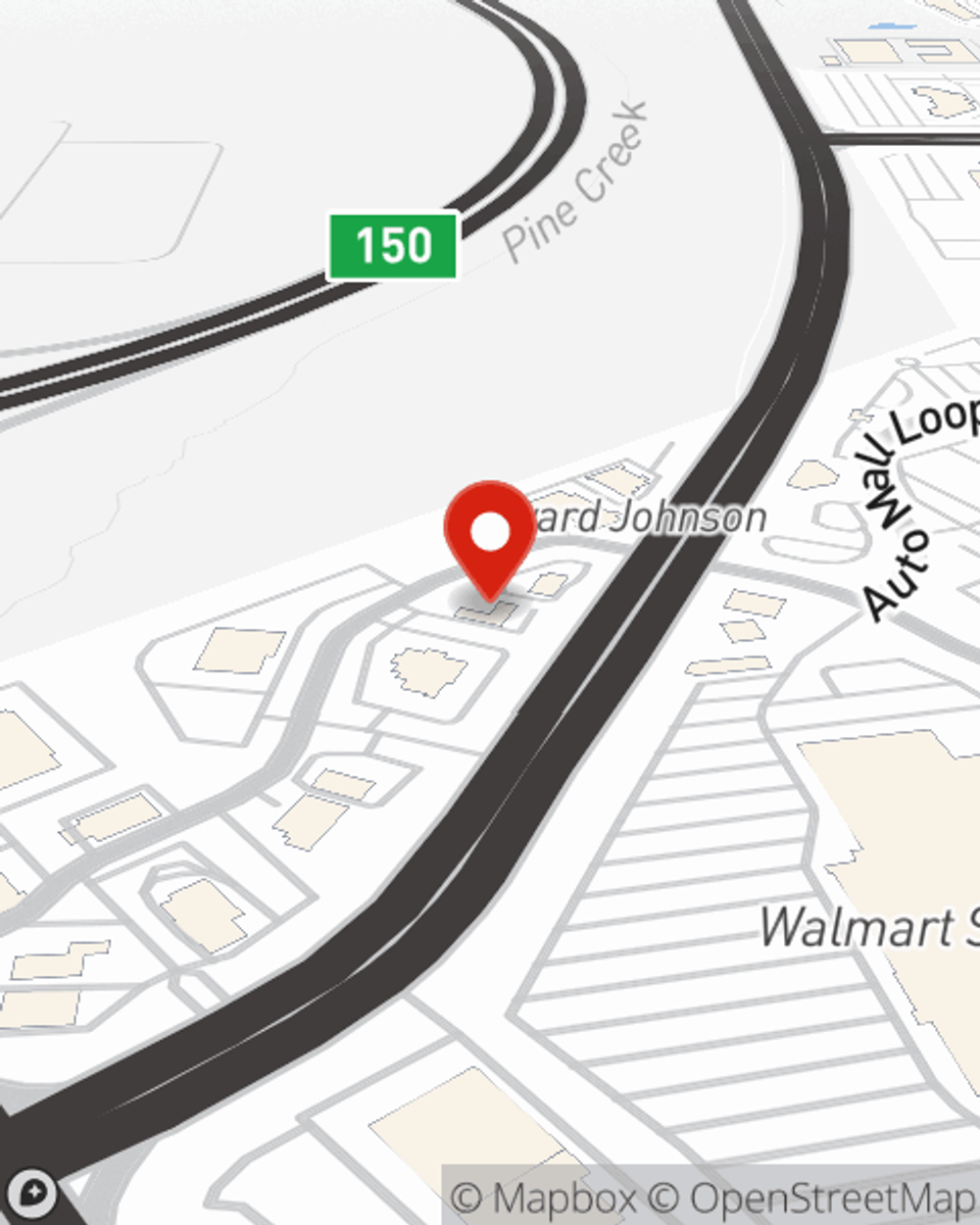

- Colorado Springs

- Denver

- Pueblo

- Peyton

- Falcon

- Flying Horse

- Banning Lewis

- Briargate

- Gleneagle

State Farm Understands Small Businesses.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or loss. And you also want to care for any staff and customers who get hurt on your property.

Get your Colorado Springs business covered, right here!

No funny business here

Insurance Designed For Small Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Chris Sutherland is ready to help you handle the unexpected with dependable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Chris Sutherland can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let fears about your business stress you out! Visit State Farm agent Chris Sutherland today, and discover how you can meet your needs with State Farm small business insurance.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Chris Sutherland

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.